Search

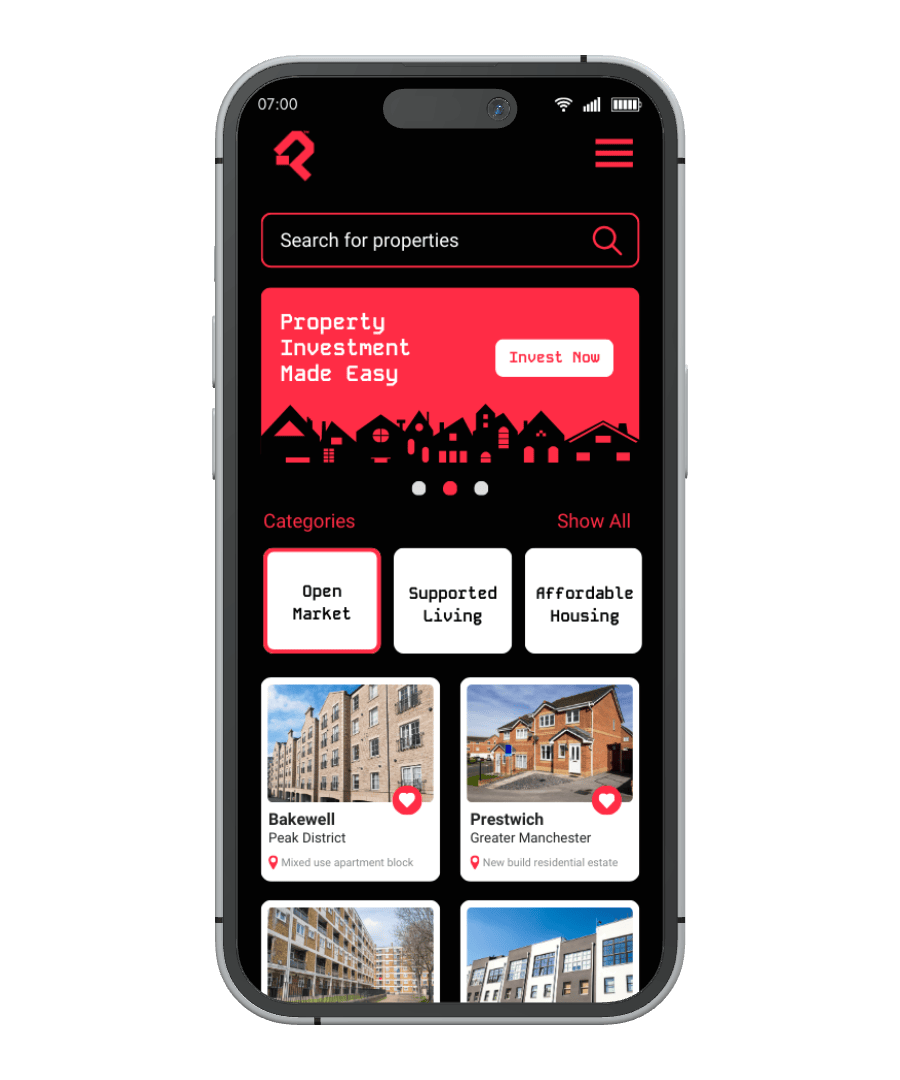

Search our collection of fully tenanted UK open market, supported living and affordable housing assets.

Buying tokenized property shares that are secured on the blockchain sounds complex doesn’t it?

It’s not.

It’s the quickest, easiest way to build a hassle free property portfolio.

Let’s show you how.

As a regulated investment platform we’re required to perform certain checks for new users on the platform. This one-off check takes approximately 3 minutes to complete and ensures the integrity of our investors.

Search our collection of fully tenanted UK open market, supported living and affordable housing assets.

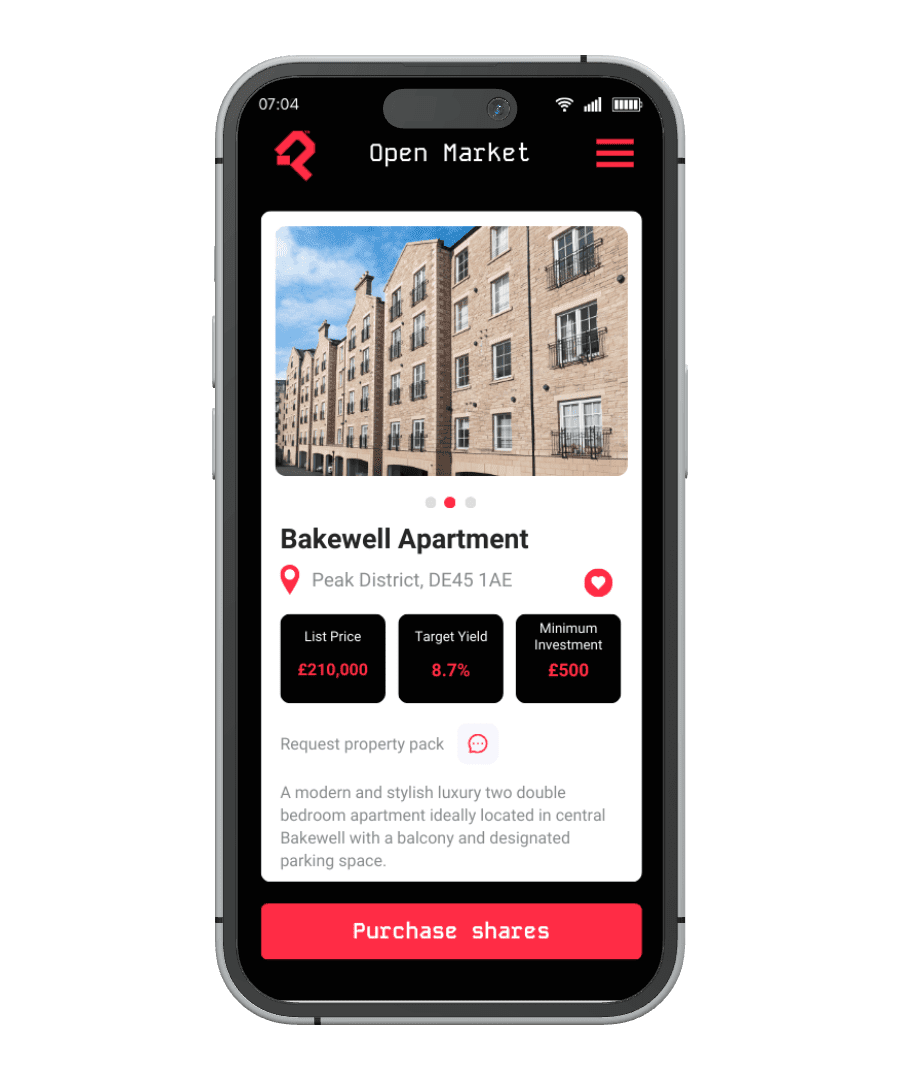

Choose the asset(s) that best fit your goals and investment strategy.

Select how many tokens you’d like to purchase, the minimum investment in each asset is £500.

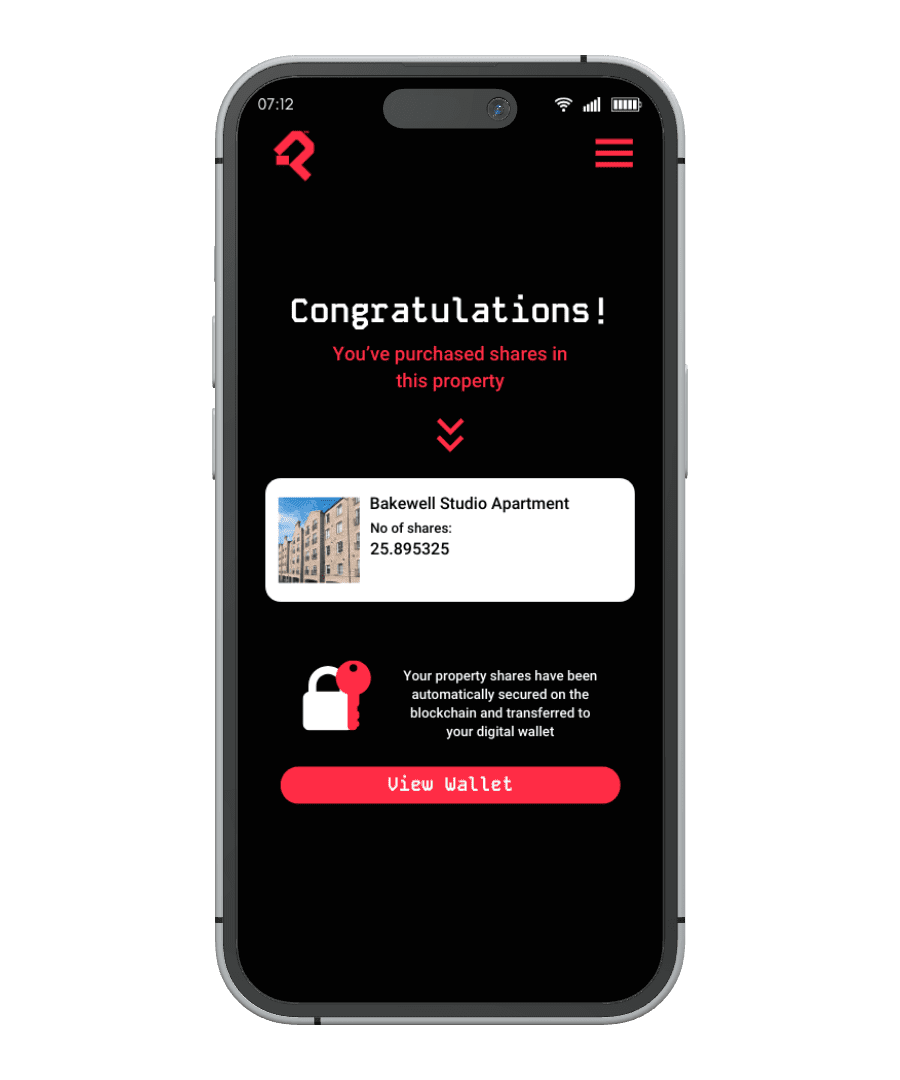

Investment information and shares are stored automatically and securely on the blockchain.

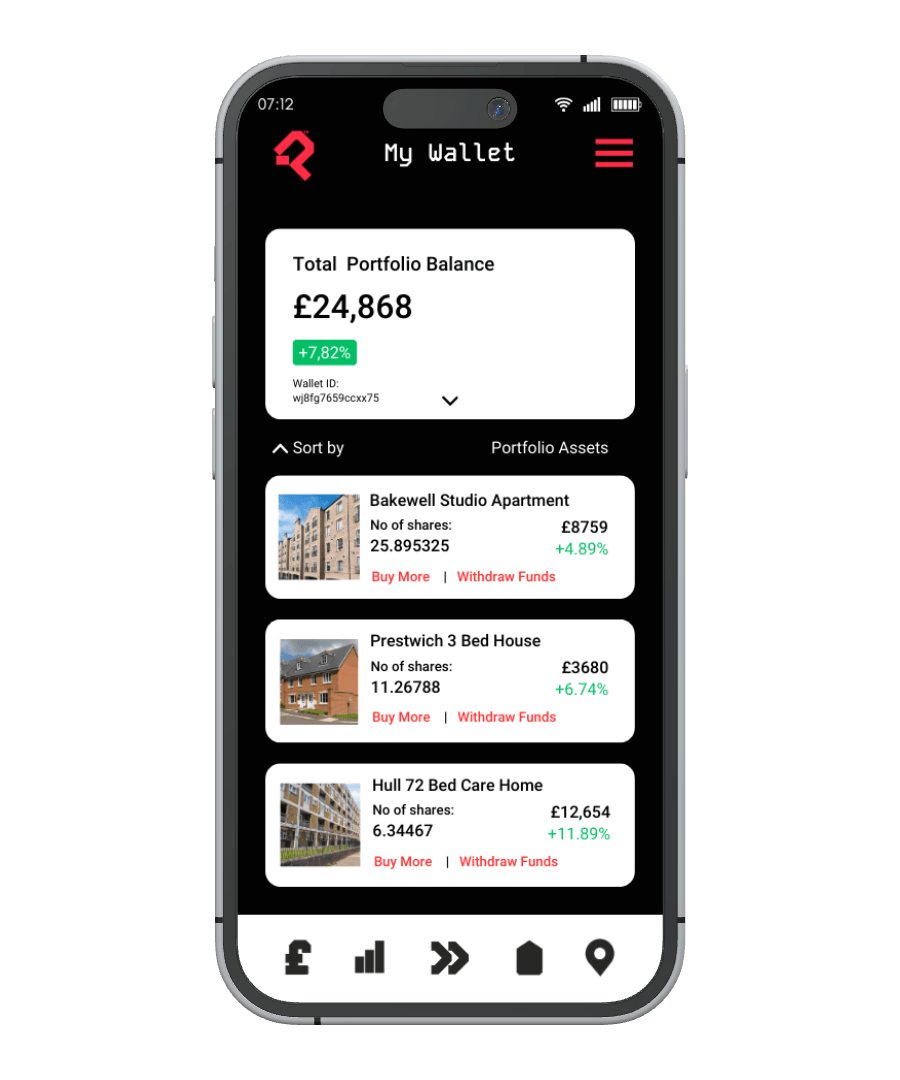

Earn reliable monthly income from your fully tenanted property investments.

As with most property investments the value of your assets will appreciate over time.

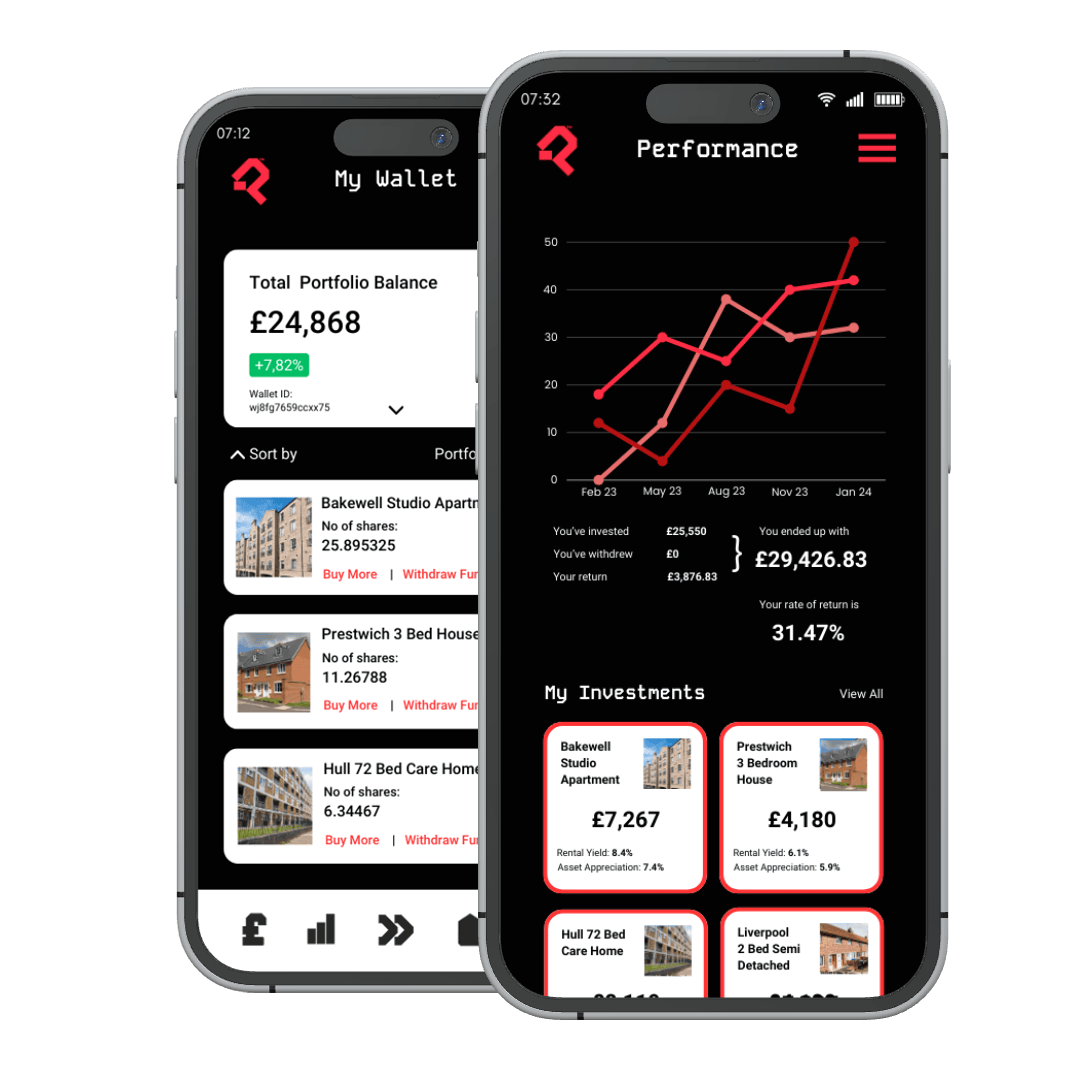

Monitor the performance of your investments with real time data and insights about your assets and their returns.

Exit your property shares with ease, list them on the exchange for sale to other investors or wait for the property’s 5 year anniversary and exit at market value.

If you have any questions that aren’t answered here, please view our full list of frequently asked questions.

What fees are involved in purchasing property shares through Property Stake?

Our fees are fully transparent. We charge the following fees for property acquisition, asset management and sale:

1% for acquisition of each property based on the purchase price.

1% for the asset management of each property based on the open market value

1% for the sale of each property based on the sale price achieved

Platform Transaction Fees

We charge 1% for each transaction on the platform

If you invest £500 the transaction fee is £5

If you sell your £500 investment, the transaction fee is £5

Who looks after the management and maintenance of the properties?

Our in-house asset management experts partner with local experts to manage each individual property. From an investor standpoint, there is no responsibility to look after the properties they have invested in- it is fully managed by the Property Stake team.

What are the minimum / maximum amounts I can invest in Property Stake?

The minimum investment amount into an individual asset is £500. The maximum amount possible to invest into a single asset will be based on the number of shares available at that time. One sole investor cannot own more than 25% of an individual property asset. For example if an asset is valued at £500,000 the maximum possible investment into that asset would be £125,000, however it’s possible to make investments across multiple assets totalling a higher amount whilst also providing greater diversification to your portfolio.

If you are looking to invest more than £100,000 we can create a bespoke property portfolio of properties tailored to your investment goals and aspirations – to do this please schedule a call with our HNW team.

We also have opportunities available for institutional investors, please contact us for more information.

How do I sell my shares in a property?

You can sell your tokens at any time to fellow investors on our secondary exchange. This flexibility helps to provide investors with the ability to manage their property portfolio with speed and ease to meet their unique investment goals.